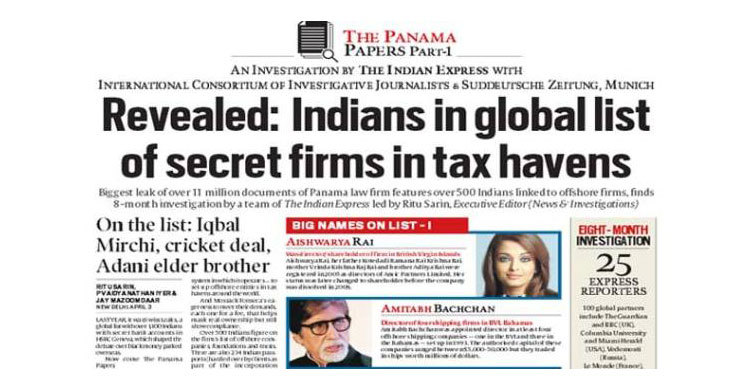

Amitabh and Aishwarya in panama papers list

Last year, it was Swiss Leaks, a global list with over 1,100 Indians with secret bank accounts in HSBC Geneva, which shaped the debate over black money parked overseas.

Now come The Panama Papers.

More than 11 million documents from the secret files of Mossack Fonseca, a law firm headquartered in tax haven Panama, known for its factory-like production of offshore companies for its worldwide clientele of the well-heeled.

These records reveal a list of individuals who have paid the firm-and bought the benefits of the secretive, lax regulatory system in which it operates-to set up offshore entities in tax havens around the world.

And Mossack Fonseca’s eagerness to meet their demands, each one for a fee, that helps mask real ownership but still show compliance.

Over 500 Indians figure on the firm’s list of offshore companies, foundations and trusts.

There are also 234 Indian passports (handed over by clients as part of the incorporation process), an eight-month-long investigation of over 36,000 files by The Indian Express has revealed.

Of these, The Indian Express has checked the authenticity of over 300 addresses.

From film stars Amitabh Bachchan and Aishwarya Rai Bachchan to corporates including DLF owner K P Singh and nine members of his family, and the promoters of Apollo Tyres and Indiabulls to Gautam Adani’s elder brother Vinod Adani.

Two politicians who figure on the list are Shishir Bajoria from West Bengal and Anurag Kejriwal, the former chief of the Delhi unit of Loksatta Party.

From Mumbai ganglord the late Iqbal Mirchi, the list includes scores of businessmen with addresses in nondescript neighbourhoods in Panchkula, Dehradun, Vadodara and Mandsaur.

Addresses of individuals, in many cases, The Indian Express found out, led to physical locations, but with no trace of the individual.

Or, as in one case, belonged to a tenement in a chawl in Mumbai.

Not just individuals, a close scrutiny of The Panama Papers by The Indian Express also reveals details of hitherto unknown deals, in some cases involving the government, too.

These include cricket franchise deals and, in several cases, linkages to those who have previously been under CBI or Income Tax scrutiny.

As per RBI norms, no Indian citizen could float an overseas entity before 2003-in 2004, for the first time individuals were allowed to remit funds of up to $25,000 a year under the Liberalised Remittance Scheme, and this limit stands at $250,000 a year now.

But while RBI let individuals buy shares under LRS, it never allowed them to set up companies abroad, having clarified it through an FAQ mid-way in September 2010.

In most of the cases in The Panama Papers, companies were set up long before the rules were changed and the purpose, experts said, was to park foreign exchange in a tax haven.

It was only in August 2013 that individuals were allowed to set up subsidiaries or invest in joint ventures under the Overseas Direct Investment window.

Indeed, records investigated reveal detailed correspondence between Indian tax authorities and those in British Virgin Islands, Seychelles, Panama or other tax havens seeking shareholder, bank account and asset details of offshore companies set up by Mossack Fonseca for Indians.

It is revelatory that authorities in these tax havens had no choice but to depend on Mossack Fonseca for information since, unlike India, the government is not a repository of ownership details.

The Panama Papers come at a time when the Special Investigating Team (SIT) on black money headed by former Supreme Court Judge M B Shah is finalising its new action-taken report.

The formation of the SIT was the very first decision taken by the Narendra Modi Government in May 2014.

The treasure trove of records was accessed by Munich-based newspaper Suddeutsche Zeitung which a year ago collaborated with the International Consortium of Investigative Journalists (ICIJ) and, in turn, with over 100 media organisations to investigate its contents.

In July 2015, The Indian Express signed an agreement with ICIJ for being the Indian partner for The Panama Papers project. Since then, a team of 25 reporters, led by the newspaper’s investigative team, joined 375 journalists in 76 countries.

Scouring electronic databases of documents registered in tax havens, joining digital dots (emails, PDF and TIFF files with one document sometimes yielding attachments with hundreds of pages of correspondence, agreements and contracts), cross-referencing company data with lists of names, The Indian Express reporters did field visits across the country to check on addresses mentioned in these records.

The Indian Express asked each one named whether they had informed RBI or the Income Tax department about these companies.

The results of that investigation-that begin in a series starting today-tell a story that’s as much about draconian foreign investment laws as it’s about glaring gaps in the regulatory apparatus.

The Mossack Fonseca data contains details of entities set up almost four decades ago from 1977 up to those registered just four months ago, that is, December 2015.

Clearly, it covers the period when India began signing tax agreements with other countries to accelerate cooperation on undisclosed and untaxed assets.

And the years when tracking black money has become the centre of political and economic discourse.

The worldwide expose also comes just six months after the 90-day “compliance scheme” for declarations of offshore assets and accounts ended on September 30, 2015 and brought just Rs 3,770 crore from 637 declarants.

The window now closed, strict penalties and a jail term have been announced for anyone found to have undisclosed and undeclared foreign assets and accounts.

The Panama Papers is the third successive collaborative project done by The Indian Express with the ICIJ on offshore investments.

The first was in 2013, titled “Offshore Leaks.” There were 612 Indians on that list which included two politicians who were then Members of Parliament (including Vijay Mallaya) and several top industrialists.

The revelations led to several persons getting tax notices and subsequently being prosecuted for non-declaration of the offshore companies.

The second ICIJ-The Indian Express collaboration, under the aegis of the French newspaper, Le Monde, was published in February 2015.

It was called “Swiss Leaks” and contained data of HSBC (Geneva) account holders-balances dating to 2006-07-among whom there were 1,195 Indian account holders.

Significantly, this was almost double of the 628 names given by the French authorities to the Indian government in 2011 and the scope of the HSBC probe was expanded following the expose.

An Investigation by The Indian Express with International Consortium of Investigative Journalists & Suddeutsche Zeitung, Munich. For all the stories from around the world go to ICIJ.ORG.