$12-15 billion laundered annually during AL regime: TIB

Bangladesh faces an estimated annual loss of $12-15 billion due to illicit financial outflows during the fallen Awami League regime, presenting a formidable challenge in reclaiming this substantial amount, according to Dr Iftekharuzzaman, executive director of Transparency International Bangladesh (TIB).

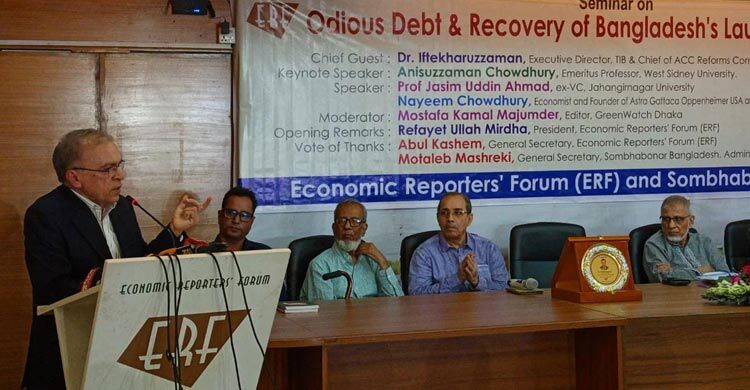

Dr Iftekharuzzaman addressed this pressing issue at a seminar titled “Odious Debt & Recovery of Bangladesh’s Laundered Wealth” on Saturday, organised by the Economic Reporters' Forum (ERF) and Sambbabanar Bangladesh at the ERF Auditorium in Dhaka.

He emphasised the importance of accountability in combating financial crime, saying, “Money launderers must face consequences, and anti-money laundering agencies should be held accountable to prevent further incidents.”

While the government has taken steps to curb financial crime, Dr Iftekharuzzaman stressed the need for stronger advocacy from civil society and political platforms to establish a sustainable anti-smuggling system.

Reflecting on recent efforts by Bangladesh Bank (BB) and the Bangladesh Financial Intelligence Unit (BFIU), he acknowledged that these institutions have historically faced criticism for turning a blind eye to money laundering under previous administrations.

However, he noted that the central bank has recently intensified efforts to address money laundering and reclaim laundered funds, though he urged for a permanent, sustainable system.

The TIB executive director also criticized the lack of enforcement on conditions imposed by the International Monetary Fund (IMF) aimed at curbing loans to fictitious companies.

“Despite IMF mandates to prevent loans to fake companies, these practices persist,” he said.

He highlighted allegations that banks, including Islami Bank, had lost funds to fraudulent companies—a practice that Bangladesh Bank has since acknowledged.

Meanwhile, legitimate companies with compliant records continue to struggle for access to loans.

The seminar’s keynote paper was presented by Dr Anisuzzaman Chowdhury, Emeritus Professor at Western Sydney University.

Other speakers included former Vice-Chancellor Professor Jasim Uddin Ahmed and economist Nayem Chowdhury, founder of Astra Gattaca Oppenheimer, USA.